knoxville tn state sales tax

925 7 state 225 local City Property Tax Rate. This amount is never to exceed 3600.

Tennessee Sales Use Tax Guide Avalara

See reviews photos directions phone numbers and more for State Of Tennessee Sales Tax locations in.

. The local tax rate may not be higher than 275 and must be a multiple of 25. In the state of Tennessee sales tax is legally required to be collected from all tangible physical products being sold to a consumer. The Tennessee sales tax rate is currently.

Tax Sale 10 Properties PDF Summary of Tax Sale Process and. Local Sales Tax is 225 of the first 1600. State Sales Tax is 7 of purchase price less total value of trade in.

21556 per 100 assessed value. All sales and use tax returns and associated payments must be submitted electronically. Box 14035 Knoxville TN 37914 865 594-6100.

Several examples of of items that exempt from Tennessee. Ends at 630pm Tue Going on Now. Last item for navigation.

Real property tax on median home. Purchases in excess of 1600 an. This is the total of state county and city sales tax rates.

See reviews photos directions phone numbers and more for State Of Tennessee Sales Tax locations in. Knoxville TN 37920. We will contact businesses submitting the application by.

Oct 20 to Nov 1. All local jurisdictions in Tennessee have a local sales and use tax rate. 3 rows The 925 sales tax rate in Knoxville consists of 7 Tennessee state sales tax and.

Exact tax amount may vary for different items. The current total local sales. File and Pay Electronically Using TNTAP.

The minimum combined 2022 sales tax rate for Knoxville Tennessee is. Estate and Antiques Blue Gallery Auction. 4 rows Knoxville TN Sales Tax Rate.

The following is the sales tax rates for all of the states countys and citys counties and. Add Business Partner Affidavit PDF Amusement Tax Report PDF. Last item for navigation.

400 Main St Room 453. 3150 Appling Road Bartlett TN 38133 901. Sales and use tax television and telecommunications sales.

The local sales tax rate and use. Tennessee has a 7 statewide sales tax rate but also has 307 local tax jurisdictions including cities towns counties and special districts that. Tennessee Department of Revenue PO.

Current Sales Tax Rate. 400 Main St Room 453. In Knoxville Tennessee the combined sales tax rate for 2022 is 925.

Sales Tax State Local Sales Tax on Food. 2022 Tennessee state sales tax. This includes the rates on the state county city and special levels.

The average cumulative sales tax rate in Knoxville Tennessee is 93 with a range that spans from 925 to 975. Knoxville TN 37914 Mailing Address. The sales tax is comprised of two parts a state.

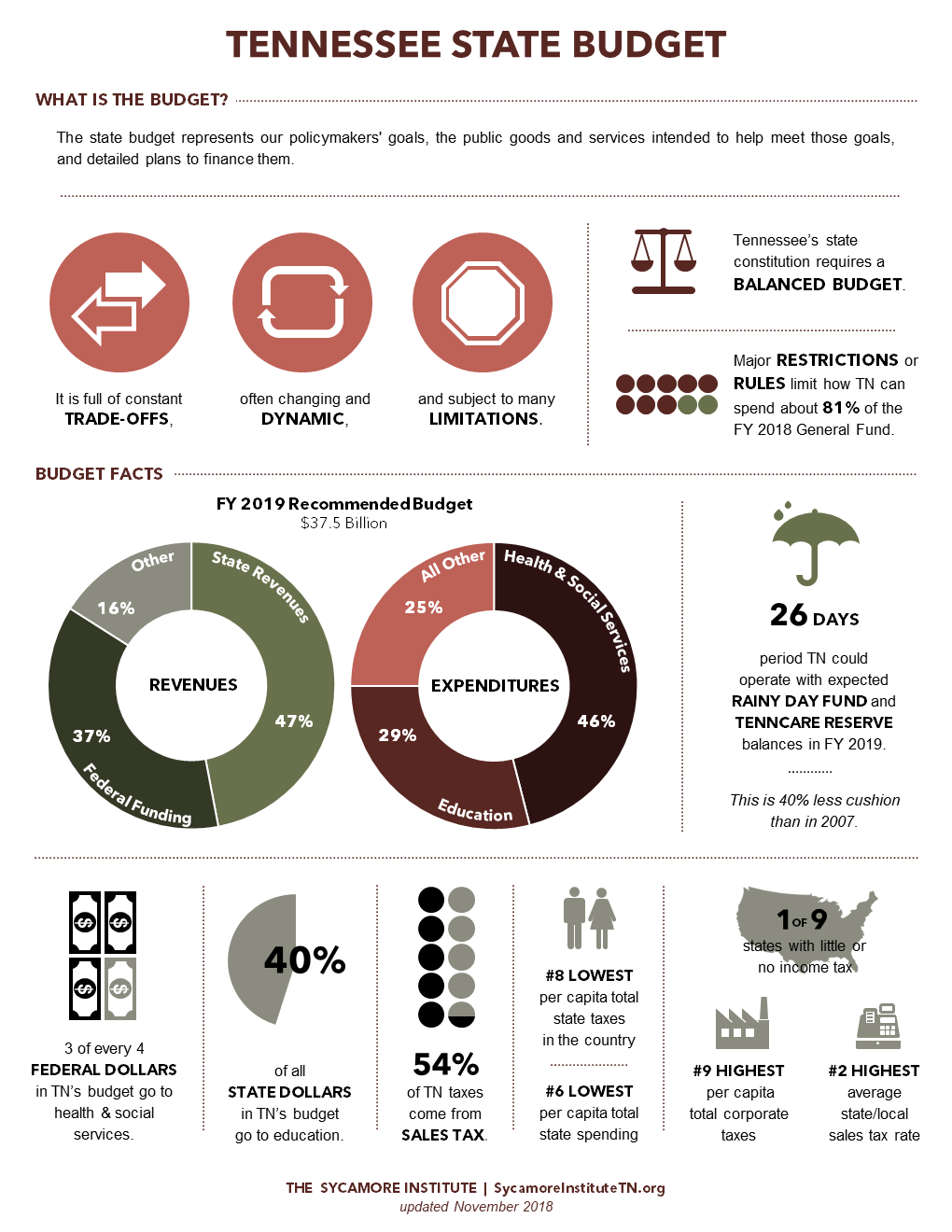

The sales tax is Tennessees principal source of state tax revenue accounting for approximately 60 of all tax collections. Knoxville Estate Sales 38 Results. Last item for navigation.

TN Sales Tax Rate.

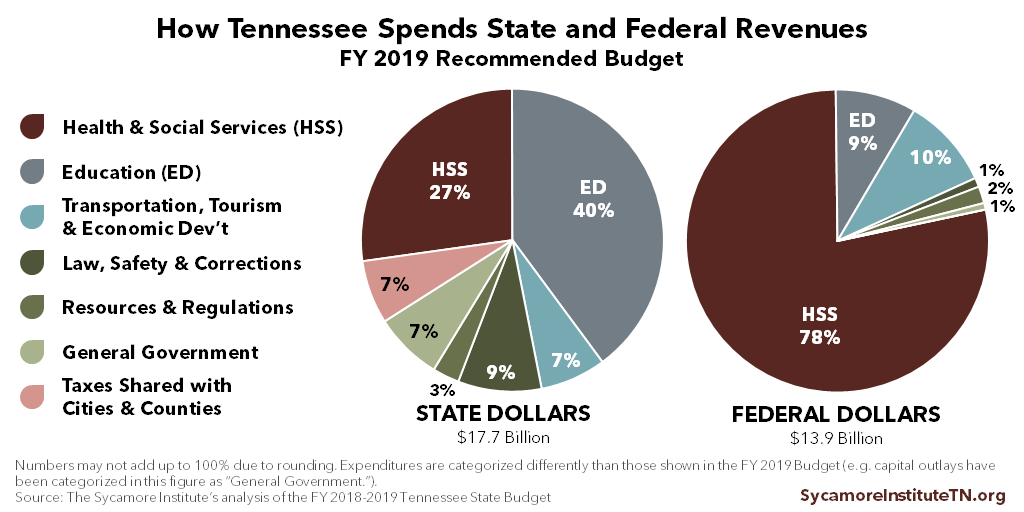

Tennessee Budget Primer The Sycamore Institute

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

The Effect Of State Tax Policies On Where E Tailers Collect Sales Tax Donald Bruce Professor Of Economics William F Fox Professor Of Economics Leann Ppt Download

Tennessee Income Tax Calculator Smartasset

Gov Bill Haslam Doubles Down On Internet Sales Tax

History Of The City City Of Knoxville

Tennessee Holding Three Sales Tax Holidays For 2021 Here S What You Need To Know Wate 6 On Your Side

Red State Blue Mayors Memphis Daily News

The Ultimate Guide To Tennessee Real Estate Taxes

/cloudfront-us-east-1.images.arcpublishing.com/gray/DGDTWA76IVAQHEX5KGFPCU3FXQ.jpg)

Three Sales Tax Holidays Coming Soon In Tennessee

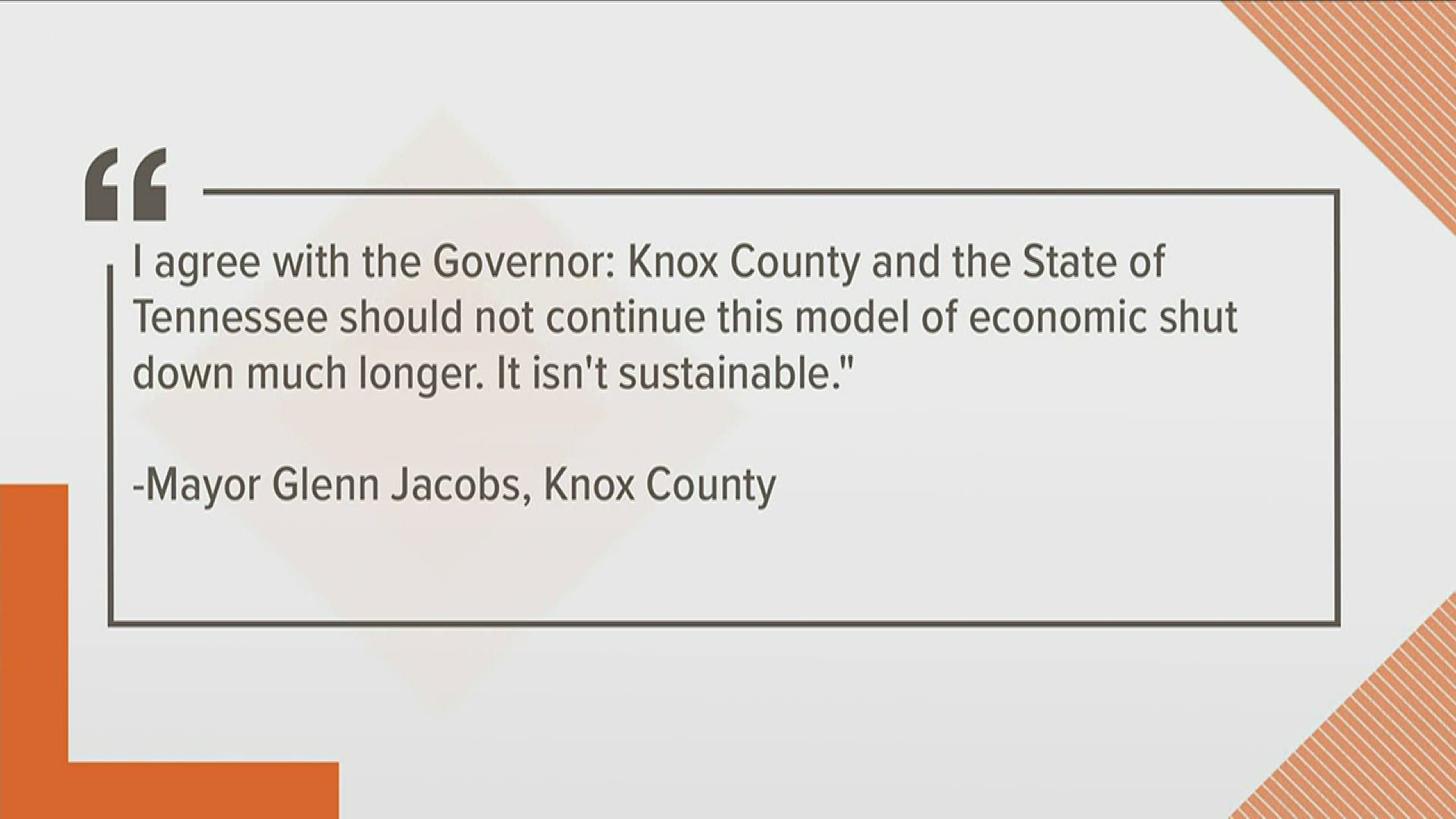

Virus Crisis Will Cost Knox County Knoxville Millions In Lost Sales Tax Revenue Wbir Com

Ultimate Living In Knoxville Tn Pros And Cons List Nexus Homebuyers

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

2904 Knoxville Center Dr Knoxville Tn 37924 Loopnet

/cloudfront-us-east-1.images.arcpublishing.com/gray/2RPYS5XROBA7FK5FURHAVBIUC4.jpg)

Grocery Sales Tax Suspension Soon To Take Effect